To plan or not to plan?

“Failure to plan is planning to fail” is the aphorism which might sum up conventional views of business planning. The concept of the professionally-managed firm highlights a standard approach to running a business; however, I know of a DBA (Doctor of Business Administration) student who took a £4m turnover business to over £100m in 12 years… without having a plan.

In the Longitudinal Small Business Survey (LSBS), a large-scale government-funded survey of SMEs, businesses are asked whether they have a plan which has been updated in the last year. So, we can investigate planning in the wider SME population using this survey source. In 2023 39% of firms in the LSBS reported having an up-to-date business plan. Looking at the data more closely, three stylised facts emerge:

- Planning is ‘sticky’. On average, from 2015-2023 if you had a plan you were 82% likely to have a plan in the next year, and if you didn’t have a plan you were 89% likely not to have a plan next year.

- Non-planning is as prevalent in the strongest firms as the weakest. After splitting firms into productivity quartiles based on turnover per employee, approximately half of firms in each quartile report not having a business plan – including those in the highest productivity group.

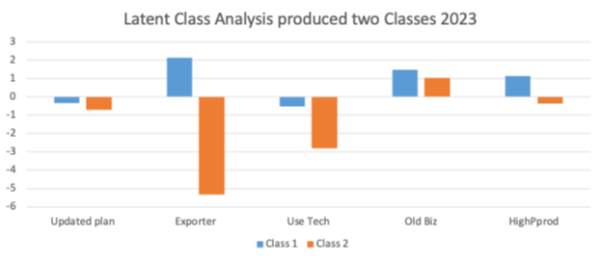

- Using a latent class analysis for 2023, we found two groups of firms both of whom tended not to plan. One group had below average productivity, and low likelihood of exporting and using technology. The other had above average productivity with more likelihood to export (but not significant) and more use of technology (see figure 1).

Latent Class Analysis

The longitudinal small business survey contains several thousand firms. Firms with their own sets of customers, with their own business practices, and with their own expectations for the future. Within this diverse set of firms, however, lie potentially different types of firms with similar behavioural patterns. For examples groups of firms who are less likely to plan. This is the question which latent class analysis tries to answer. Latent class analysis, as a statistical technique, uses responses to observed variables to find unobserved (latent) groups in the data. Latent class analysis can identify hidden subpopulations in the LSBS.

In our case for 2023, latent class analysis identified two hidden subpopulations in the LSBS based on planning, exporting, tech use, business age and above average productivity. Figure 1 shows the two firms’ groups, class 1 and class 2. The blue bars represent class 1 and class 2 is represented in the orange bars. The vertical axis shows the logit coefficients associated with class membership. A high positive value suggests firms with that attribute are associated with the class. It turns out that we have two groups of firms both of whom are unlikely to plan.

Figure 1 – Latent Class Analysis

Let’s examine class 1 in the blue bars. First, in figure 1 for updated business plan, the slightly negative blue bars indicate that class 1 firms are less likely to have an updated business plan. Next, for exporting, strongly positive blue bars show class 1 firms are around eight times more likely to be exporters. Technology use is slightly negative in class 1. The blue bars for older businesses are positive, associating older firms with class 1. Finally, class 1 firms are more likely to have above average productivity. Overall, class 1 firms are not planners but are more likely to be older, exporting, productive firms. Hence, the latent class analysis exposed a group of non-planning, productive firms in class 1.

Turning to class 2 in the orange bars. Again, a negative orange bar for planning indicates class 2 firms avoid an updated business plan. They avoid exporting too as the strongly negative orange bars for exporting indicate. Again, technology use is slightly negative in class 2. Positive orange bars associate older firms with class 2. Finally, class 2 firms are not more likely to have above average productivity. Class 2 firms eschew planning, exporting and technology making them perhaps the stereotypical underperforming small firm. Consequently, the latent class analysis exposed two sets of low planning firms. One had low exporting and low productivity but the others were more productive, exporting older firms.

Whether a firm plans or does not to plan seems to reflect preference. Planning maybe beneficial, but some firms clearly found a method to develop their business which did not involve planning. For example, the business owner who took their business from £4m to over £100m followed a set of business practices, including cost controls and managing employee performance. The point to make here is the successful management of small firms is more heterogeneous than suggested by the ‘standard’ professionally managed firm.

It is possible therefore that there might be resistance from some businesses to interventions that require them to engage in business planning. We need to think about how the planning averse might be supported because these firms might be capable of growth, but since they do not fit the template of the ‘professionally managed firm’, they might avoid or not be targeted for support. In other words, they are not the ‘usual suspects’ for intervention…But these firms are failing to plan, not planning to fail, and some are thriving.

Kevin Mole , Associate Professor of Enterprise, Warwick Business School

Please note that the views expressed in this blog belong to the individual bloggers and do not represent the official view of the

Enterprise Research Centre, its Funders or Advisory Group