R&D: What can the Great Recession tell us about the likely impact of COVID-19?

It seems increasingly clear that the economic impacts of COVID-19 will be startlingly sharp for the UK and other world economies. The great unknown at present is whether the historic quarterly contraction we’re expecting to see in Q2 of 2020 is followed by a rebound, or a deep and painful recession.

What’s also difficult to discern is how this will play out at firm level, particularly when it comes to innovation. The proportion of firms engaging in research and innovation (R&D) and the amount of money they spend on it (supported, in some cases, by government and agencies such as Innovate UK) can give us useful insights here, and previous ERC research suggests that the economy as a whole benefits from it.

So, what could we expect to see in the wake of coronavirus? Will firms continue to prioritise the development of new products, services and ways of working? Or will a hit to turnover and prolonged drop in demand cause them to scale back their efforts?

Our new analysis of what happened after the Great Recession of 2008-9 suggests some possibilities. Then, as now, all sectors were swept up in an enormous system-wide economic shock beyond their control. The effect on innovation was rapid, but it’s only with hindsight now that we can see the longer-term impact on sectors and regional inequalities.

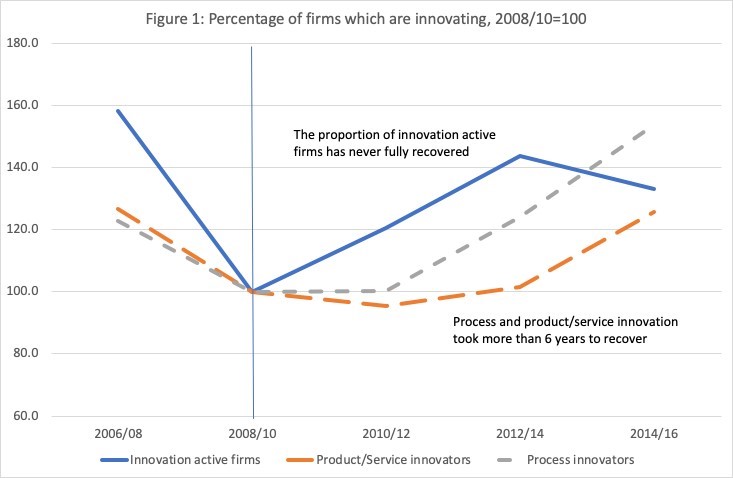

Looking at the bi-annual UK Innovation Survey, what’s immediately striking is the dramatic impact of the recession on the number of firms engaging in innovation. The proportion of all firms classed as ‘innovation active’ fell from 58.2% in 2006-08 to 36.8% in 2008-10 – a drop of more than a third. What’s more, overall levels of innovation still hadn’t recovered by 2014-16, when this figure stood at 49%.

Of course, ‘innovation’ covers a whole host of activities, taking in everything from the eye-wateringly expensive and lengthy development of new drugs by a pharmaceutical firm to an artisan bakery’s new marketing approach. Helpfully, the statistics allow us to break things down.

Looking at ‘product and service innovators’ – around one in five UK firms – the proportion fell by around a quarter and had only just recovered by 2014-16. ‘Process innovation’ – leaner or more effective ways of working – was less severely affected and ‘wider innovation’ – covering marketing, strategy and partnerships – actually increased during the recession.

Regionally, North East England stands out as continuing to have fewer innovating firms in 2014-16 on most measures than it did before the recession. Everywhere, SMEs were affected more than large firms. And from a sectoral point of view, manufacturing tended to recover more slowly than services.

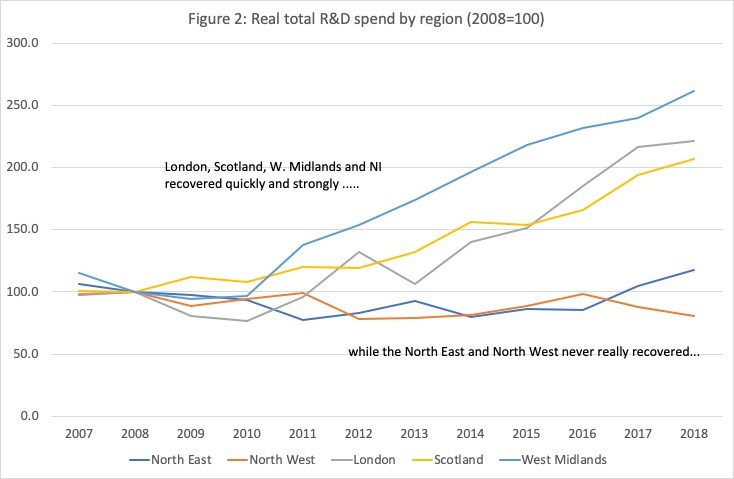

And what about overall investment? Turning to the annual Business Expenditure on R&D (BERD) database, the picture is somewhat surprising. In fact, overall spending on R&D only declined by 5% between 2007 and 2009 (from £19bn to £18.1bn in 2018 prices), before growing steadily to reach £25bn in 2018.

And it’s here that we see a really startling regional divide. The West Midlands, London, Scotland and Northern Ireland all saw spending more than double in real terms over that timeframe. Meanwhile, the North East and East of England saw barely any rise at all, and in the North West, real terms spending on R&D actually fell by 17%.

This is partly explained by big investments in some major, regionally-concentrated sectors. The automotive sector, for instance – largely based in the West Midlands with big hitters like Jaguar Land Rover – saw a rise in R&D spending of more than 230%, reaching £3.8bn in 2018. Meanwhile, other important manufacturing sectors including aerospace and pharmaceuticals saw absolute declines, possibly connected to the uncertainty over Brexit.

So will the R&D landscape be similarly affected by COVID-19? It seems reasonable to assume that, faced with a dramatic drop in revenues, many firms will decide to abandon activities which might be seen as peripheral to the core business, or too risky to commit to in a downturn. And if the ‘long tail’ of coronavirus merges with renewed fears of a ‘No Deal’ Brexit cliff edge at the end of this year, we could see a perfect storm of uncertainty quash any hope of a quick rebound.

In recent weeks, the UK Government has announced a £1.25bn package of grants and loans to support fast-growing innovative firms and SMEs already receiving support from Innovate UK to help them cope with the impact of coronavirus.

That of course is welcome. But its success will be contingent on firms themselves being willing and able to match it with private patient capital and strategic commitment. With most firms facing battered balance sheets and a global economy still reeling with PTSD, that could be a tall order indeed.

Stephen Roper, ERC Director

Please note that the views expressed in this blog belong to the individual blogger and do not represent the official view of the

Enterprise Research Centre, its Funders or Advisory Group.