State of Small Business Britain Conference 2019 – UK manufacturing ‘fragile’ as Brexit nears – research

● ERC warns of a “breakdown in dynamism” as Brexit fears stalk the sector

The UK’s manufacturing sector is in a “fragile” state, with slower growth and a drop in start-ups revealing a wider malaise beyond the troubles of the car and steelmaking industries, new research shows. The Enterprise Research Centre’s State of Small Business Britain report presents a new analysis of the fortunes of the manufacturing and services sectors since the Great Recession of a decade ago.

“These announcements have to be seen in a wider context of slowing growth across the board which, combined with falling numbers of new firms starting up, is leading to a breakdown in business dynamism across our industrial base.

“While manufacturing may play a smaller role in our economy than in the past, it remains vital to the success of our economy and continues to make up over 40% of our exports by value.

“The ongoing uncertainty around Brexit will doubtless be contributing to the fragility we’re seeing in the growth of manufacturing firms. What those firms badly need is an indication of when some sort of stability is going to resume. It’s only then that this cloud of despondency hanging over the economy is going to clear.”

Case study: “Having all my eggs in Brexitland isn’t a long-term strategy anymore”

While many manufacturers are still seeing growth, Brexit uncertainty is influencing how they achieve it. This has been the experience for Greg McDonald, Chief Executive of injection-moulding firm Goodfish Group, headquartered in Cannock near Birmingham and with other sites in Worcester and Loughborough.

Since founding the company – which makes plastic components for a wide range of sectors including retail, automotive, aerospace and healthcare – in 2010, Mr McDonald has grown the firm’s headcount from around 30 to 125 through a string of acquisitions, with a turnover of £11.5m.

But the uncertain climate has forced Greg to explore new avenues for future expansion. Goodfish has established a subsidiary in Slovakia, an emerging centre of automotive production in continental Europe, and is waiting on the outcome of the political deal around the UK’s departure from the EU before signing a lease on a new facility, which it hopes to be manufacturing from within six months.

“My mindset as a business-owner is that having all my eggs in Brexitland isn’t a longterm strategy anymore,” said Mr McDonald. “Whatever happens will, over the longer term, put a cap on job creation in the UK and some of that will be diverted to Central and Eastern Europe.” He has also seen a number of foreign-owned firms selling off their UK manufacturing facilities and believes this indicates the high-water mark of overseas investment in British factories may have passed. “You might see some onshoring or re-shoring, but actually the ownership of manufacturing in the UK has already been capped,” he said. “Business people don’t wait for politicians to make up their minds about how things are going to turn out.”

Policymakers could encourage smaller firms to grow staff numbers by reducing the burden of PAYE and national insurance contributions for younger companies, Mr McDonald said – as well as addressing the high up-front rental fees demanded by landlords on leased premises.“Basically to help an economy to grow, you want start-ups to be able to scale up,” he added. “Big companies tend to constantly reduce employees to increase productivity, whereas scale-ups are trying to build a business and whatever you can do to make that easier has got to help.”

ENDS

Notes to editors

1. Full report

3. Charts

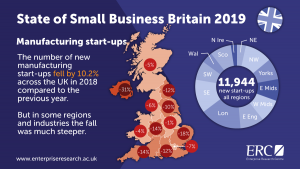

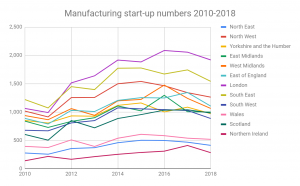

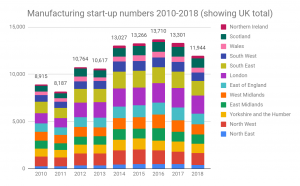

(a) Manufacturing start-up numbers, 2010-2018 by UK nation/region

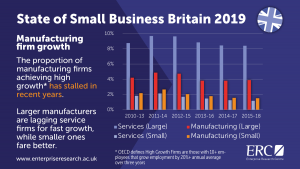

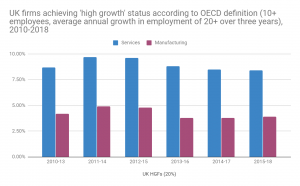

(b) Firms achieving ‘high growth’ status, Services vs Manufacturing 2010-2018

ERC is the UK’s leading independent research institute on the drivers behind the growth and productivity of small and medium-sized enterprises (SMEs). It is funded by the Department for Business, Energy and Industrial Strategy (BEIS), the Economic and Social Research Council (ESRC), Innovate UK, The Intellectual Property Office (IPO) and the British Business Bank (BBB). ERC is producing the new knowledge around SMEs that will allow us to create a business-friendly environment nationwide, grounded in hard evidence. We want to understand what makes entrepreneurs and firms thrive so we can spread the lessons from best practice and make the UK a more successful economy. The Centre is led by Professors Stephen Roper of Warwick Business School and Mark Hart of Aston University, Birmingham. Our senior researchers are world-class

academics from both Aston and Warwick Universities as well as from our partner institutions which include Imperial College, Queens University Belfast and the University of Strathclyde.